NEWS

January 31st Self-Assessment Deadline for Therapists and Psychologists

The HMRC Self-Assessment deadline of 31st January is approaching, and for many therapists, psychologists, counsellors and mental health professionals, this can be a particularly busy and stressful time of year. Managing client work alongside financial compliance is...

Looking Back at 2025: Key Tax and Money Changes Affecting Therapists and Psychologists

As we move through 2026, it’s a good time to reflect on the financial and tax changes introduced during 2025 and what they now mean in practice for therapists and psychologists. One of the most welcome developments last year was HMRC’s move to simplify Self Assessment...

How to Use AI Invoicing

For mental health professionals, psychologists and therapists, the focus is on people: listening, guiding and supporting clients through their journeys. Yet behind every meaningful session is the less-glamorous side of practice management – invoicing, bookkeeping and...

How AI is Changing Accountancy for Therapists

Therapists and mental health professionals know that time is precious. Between managing sessions, safeguarding clients, and handling paperwork, financial administration can feel overwhelming. Fortunately, artificial intelligence is reshaping accountancy in ways that...

Guide for Therapists – Self-Employment Tax Return

As a therapist running your own practice, completing your Self-Assessment doesn’t need to be stressful. Here’s your streamlined guide. 1. Do You Have To File? If you earned over £1,000 from your therapeutic services (e.g., counselling, coaching, workshops), you must...

Making Tax Digital – What It Means for Mental Health Professionals

If you're a therapist, counsellor, psychologist, or mental health professional, big changes are on the horizon for how you manage your tax. Starting April 2026, Making Tax Digital (MTD) for Income Tax will apply to anyone earning over £50,000 from self-employment or...

Therapists: Could Hidden Cash Be Sitting in Your Practice?

Recent figures reveal that around £6.6 billion in old UK banknotes and coins remain unreturned — despite many of them no longer being legal tender. Paper £20 and £50 notes were withdrawn in 2022, and yet 375 million paper notes are still in circulation, including...

HMRC Fuel Rates Changes: Implications for Businesses

From 1st June 2025, HMRC is updating its Advisory Fuel Rates (AFRs) – the amounts you can claim for business mileage in company vehicles or repay for personal use. While the changes are small, they can affect your practice’s expenses and tax position. Key updates...

Upcoming HMRC Interest Rate Rise – What It Means for Mental Health Professionals

From 6 April 2025, HMRC increased its interest rates on late tax payments – a change that could impact the finances of many mental health professionals across the UK. With the late payment rate rising by 1.5 percentage points, there’s never been a better time to...

Spring Statement 2025

On 26 March 2025, Chancellor Rachel Reeves outlined economic changes that could impact therapists, especially those who are self-employed. Here’s what you need to know and how we can help you prepare. Key Changes Affecting Therapists 1. Tax Penalties—Avoid Extra Costs...

Side Hustles: Understand Tax Implications

In today's dynamic economy, many individuals are exploring side hustles to supplement their primary income. Whether it's selling handmade crafts online, offering freelance services, or renting out property, these ventures can provide financial flexibility and personal...

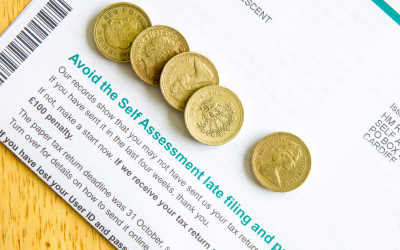

Why Is It Important to File On Time

The clock is ticking! The self-assessment tax return deadline is fast approaching, and for therapists and mental health professionals, it’s essential to be prepared. Filing your tax return by 31st January 2025 might feel like just another task on your list, but it’s...

Self-Assessment Tax Return Deadline: 31 January

For mental health professionals, managing your workload while staying on top of financial obligations can feel overwhelming. However, the 31st January deadline for submitting your self-assessment tax return is non-negotiable, and missing it will result in penalties....

How Does the 2024 Budget Affect You

Rachel Reeves’ 2024 Autumn Budget brings key changes across income taxes, benefits, and living cost support, designed to aid UK households amid inflationary pressures. Get in touch with us if you want to understand more about these changes and need help. Pension...

Understanding the Non-Resident Landlord Scheme

The UK Non-Resident Landlord (NRL) Scheme is essential for landlords living abroad who earn income from UK property rentals. Under this scheme, letting agents or tenants who pay rent directly to non-resident landlords must deduct basic rate tax from the rent before...

AI-powered Tools are Reshaping Accounting

With advances in technology, AI-powered accounting tools are reshaping financial management for small businesses, offering greater accuracy, efficiency, and insights than ever before. By automating tasks like data entry, expense tracking, and report generation, AI...

Why Mental Health Professionals Need an Accountant

Mental health professionals, like therapists and psychologists, often focus solely on supporting their clients' well-being, but keeping an eye on the financial side of their practice is just as important. This is where having an accountant can make all the difference....